The technical analysis is classified in to two different types called objective and Subjective. Here we will see how these different types of technical analysis work to give advantage to the traders.

Subjective Technical Analysis

Subjective technical analysis incorporates methods and patterns which are not precisely explained. Finally the output derived from the subjective method is based on individual interpretation of the methods applied by the analyst. Often this method causes two analysts although using similar market data, to get different results or conclusion. Due to this reason, the subjective method is untestable and it is practically impossible to program in computer.

Objective Technical Analysis

The objective method is not like that. Objective technical analysis clearly explained rules as compared to subjective analysis. The criteria for using objective method on market data and its solution is very precise. So we can apply this method on previous and old data to find out the performance level of the rules. This is often called back testing. The objective method back testing allows us to check rules for profitable results with statistical evidence. So this back testing really help to identify which objective rules have been performing and which ones have not.

The acid test for identifying objective from subjective method is a programming principle. A strategy is objective if and only if it can be executed as a PC program that produces clear-cut market positions (like Buy, sell or hold). All techniques that can’t be reduced to such a program are, as a matter of course, subjective.

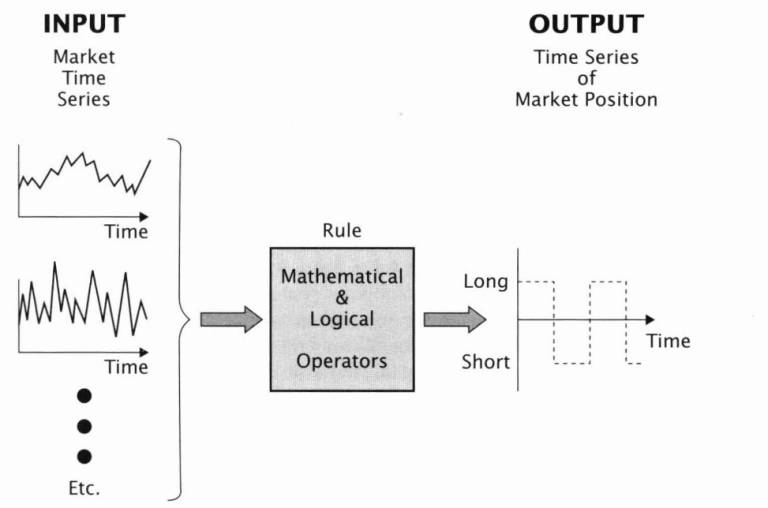

Here the objective technical analysis strategies are called as mechanical trading rules. A rule changes input information to output which is also the required market position. The rules used for objective trading system are one or more mathematical and logical functions operators that convert the time series of input (market prices like daily open, high, low, close) into new output time series be formed as the series of suggested position of market. Here the output is defined by system sign +(Long) or – (Short). Here the convention of positive values assigned and indicates as long position and negative values are defined as short position.

A rule is used to produce a market position signal when the input conditions ( like market price and/or other indicators)changes to precisely defined values… The signal change is referred as new suggested position in the market as per the trading system. For example, when the system output is varied from +1 to -1, it requires trader to close long position and open short position.

A rule is used to produce a market position signal when the input conditions ( like market price and/or other indicators)changes to precisely defined values… The signal change is referred as new suggested position in the market as per the trading system. For example, when the system output is varied from +1 to -1, it requires trader to close long position and open short position.

Evaluation of Rules – Binary Rules and Threshold

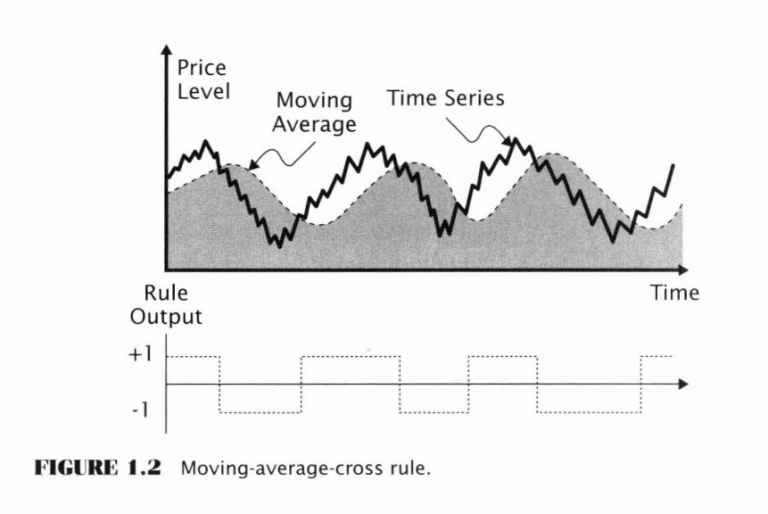

Binary rule is simplest rule that produce simple binary output. The binary value represented by two values as +1 and -1. Basically the Binary rules are used to suggest long/neutral or short/neutral position. But here it is used to represent long/short position of the trading system between {+1 and -1}.

How the Binary rules be Used in Trading

How the Binary rules be Used in Trading

When you learn trading, the binary rule is a very important method to objective analysis of market data. In trading strategy, binary rules are used to represent the position of the market in terms of long or short position. A trading system that is either long or short based on binary rules is always in the Market. This rule is also referred as reversal rule. Because its output signal is varied between short to long and also long to short.

The precise mathematical and logical operators that are used to define the rules may vary significantly. One of the concepts called threshold, it identifies the changes that happened in input time series (like market prices) only when they are greater than a critical value.

The principle here is that changes in the input time series (market prices and various indicators) are a combination of information and noise. Therefore the threshold is used as a filter to identify only significant change.

Finally compared to subjective method, objective method offer more exact and efficient trading signal to trade with confidence. The confidence comes from our ability to test and confirm profitability of trading system before use. Share market courses in Mumbai offers this technical analysis courses to best traders.

For more : Share Market Classes in Chennai | Stock Market Institute in Delhi