Super Gann Trader Academy which conducts share market classes in Chennai, offers free trader awareness lessons.

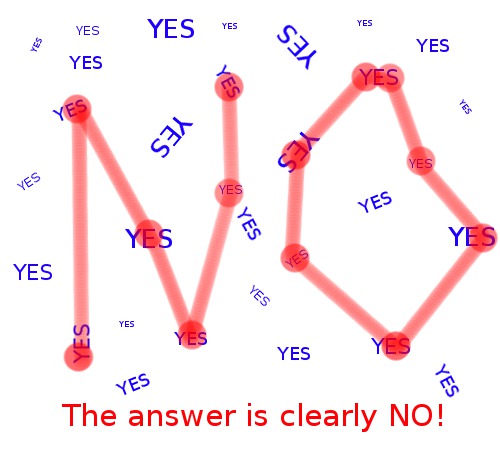

We see what we want to see

We see what we want to see

A confirmation bias is a thinking bias that causes self harm due to a blind spot in our thinking. We are not aware that it exists and how it affects our behavior and perception of reality.

Confirmation bias causes us to favor information that supports our belief and ignore other information. This causes us to be selective in our evidence collection and its subsequent memory retention. We only remember instances which support our belief.

It also affects our perception of new information.

Examples of confirmation bias:

- John is interviewing Mark for a job. He believes Mark is highly intelligent. He gives higher importance to all evidence that supports Mark’s intelligence and ignores other contrary information.

- A reporter, who believes in capital punishment, or any other society issue, seeks out information and instances that support his belief and writes articles supporting his belief and supporting his view with the confirming evidence collected.

- Police is investigating a crime case. Once they form a belief and a coherent story of the crime, they will seek evidence supporting their theory whilst ignoring other evidence lying in front of their eyes.

- Political parties with opposing beliefs will see the same event with a completely opposite perception. One can watch aggressive debates on hot topics in the evening news. These debates are a result of perception differences caused by confirmation bias of opposing parties.

- Janet believes that brown-eyed people are selfish. Whenever she sees a person with brown eyes, she becomes alert and observes all evidence that support her belief. She ignores all actions where a brown eyed person had helped her or others.

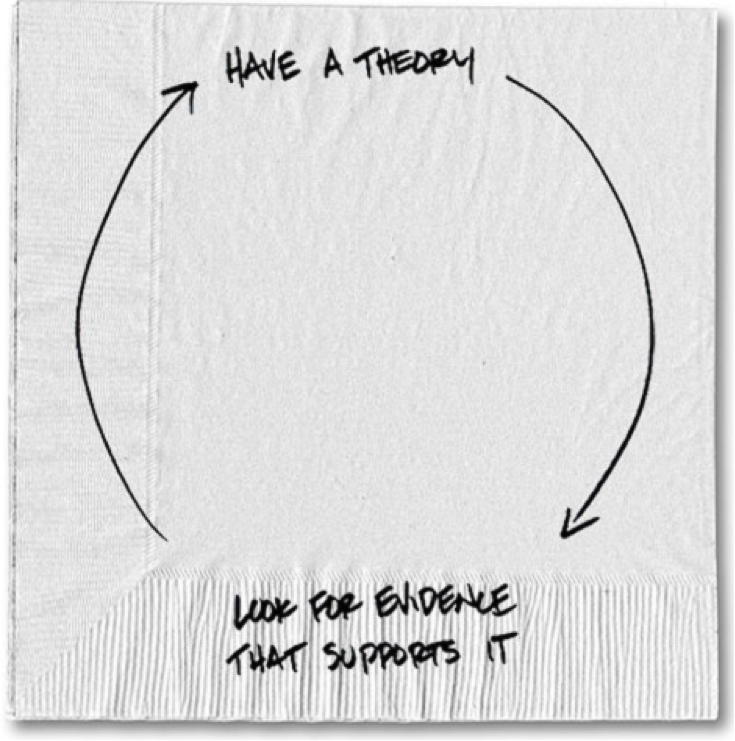

Vicious circle of confirmation bias behavior:

How confirmation biases harm us in stock market?

How confirmation biases harm us in stock market?

Varun reads all the business newspaper every day. He keeps track of the stock market through his favorite business channel program in the evening. Every day he reads and hears everything regarding the booming economy and rising stock market. He forms a belief that this is a bull market. He begins investing in a stock ABC that is leading this bull market.

Varun reads all the brokerage reports that have given ‘buy’ recommendations to company ABC. When he encounters some news or report that suggests ABC shares are overpriced, he interprets it as the company commands premium in stock market because of its leadership and management. He adds more shares when price corrects, as he sees it as a buying opportunity.

He asks others of their opinion on this company ABC. If they are positive on this company, he talks to them in greater details. However, if they are negative on this company he cuts the conversation short and seeks someone else who shares his beliefs.

He ignores all warning signs that ABC stock price drops, even when the news of excellent quarterly results or other positive news about the company are announced. Although price of ABC share is dropping steadily, he concentrates on those days when price goes up, thinking that the stock has bottomed out and will soon regain its past glory.

However, as the stock price has come down to 25% of purchase price, Varun now views his investment as a long term investment. He is still waiting to get his money back.

Varun lost money as he was blind to the confirmation bias (blind spot) in his thinking. He only looked for evidence that supported his investment decision in company ABC and ignored other contrary evidence.

We can avoid this trap of confirmation bias in our thinking by using trading systems.

Trading systems are simple set of black and white rules that are tested before use to confirm profitability. Trading systems help us evaluate market information objectively.

We train traders/investors in use of tested trading systems and help them set up a profitable trading business. Join our share market training courses to become a top trader.